What if I told you that, when it comes to where you live, you can have your cake and eat it too?

What if there was a way for you to live in a highly desirable area — San Francisco, Chicago, New York — but you never had pay rent or a mortgage payment?

At the time of this writing, I’m living in Chicago — Rogers Park to be exact — and lovin’ my life in the big city.

There is always something going on! I’m literally a 5-minute walk to the beach on Lake Michigan. I have all the ethnic cuisine I could ever want at my fingertips. All in all, I've found a community here like I’ve never experienced before.

Life is truly incredible here, and my family and I are happier than we’ve been in a long time.

There’s just one, tiny problem: My rent is $1,450 a month! This is, of course, insanely expensive.

But here’s what’s even crazier: As far as big cities go, $1,450 per month is considered CHEAP.

The True Cost of Living in a Big City

Back where I lived previously, in the San Francisco Bay Area, my home was a 600-square-foot apartment, in a really rough part of San Jose. Homeless people routinely ate out of my garbage can. People were selling drugs on the street corners.

My rent there was $1,800 a month, and these days, I would be paying about $2,500+ for the exact same place.

Given how residential values have skyrocketed in the most popular urban areas nationwide, the possibility of ever owning a house in one of these major cities is a pipe dream for many.

Add in the continual rise of property taxes each year (mostly a Chicago problem) with increases in gentrification, and home prices just keep going up and up and up, with no clear end in sight.

When I spoke with a lender to explore some options here in Chicago, he told me I needed to shoot for a purchase price of at least $500,000, which translates to an average monthly mortgage cost of $2,600 plus $500-$1,000 in property taxes per month!

That’s over $3,000! I just can’t justify that; I’ve simply been ruined to expensive real estate due to my years as an investor.

How to Have Your Cake and Eat It, Too

So, the question becomes: What do we city-lovers do?

We want to be financially wise, invest our hard-earned cash carefully and wisely, and save for our future. But who wants to live in the middle of Nowhere USA in order to do it?

I don't. I’ve tried it, but it’s simply not for me. Chicago has to be a major part of me and my family’s life in the future.

I was determined to figure out how to do life in the big city, while still being financially savvy — a tough challenge, to say the least — and one for which I've found a solution.

Say Hello To House Hacking!

“House Hacking” is essentially a way for you to use creative real estate tactics to extremely lower or, as I plan on doing, completely eliminate your monthly housing costs.

The term has been widely popularized by our friends over at BiggerPockets and is typically talked about in the context of buying a 2-to-4-unit apartment building, living in one of the units, and renting out the other(s).

This is one type of house hacking I’ll be covering in more detail shortly, but there is actually more than one way to do it.

In my research, I discovered there are actually three different ways you can hack your mortgage:

- Having roommates.

- Using an extra room or in-law suite to Airbnb.

- Owning and living in a small apartment building (typically 2-4 units).

To figure out which method was the best fit for me, I interviewed a few experts that specialize in each method, and I'm bringing you along for the ride with me.

Below, you'll find each interview I conducted, along with an overview of each strategy as well as their pros and cons.

Without further ado, let’s dive in!

House Hacking with Roommates

Interview with Lucas Haul, Cozy.co and Landlordology.com

Overview

There are three primary ways you can go about house hacking with roommates.

- Rent out each room of a large, single-family house, sharing some of the common areas, including the kitchen, bathroom and laundry area.

- Convert a basement into an additional unit and then rent it out, creating a duplex (or 2-unit).

- Combine the two; convert your basement to host several rooms and rent them out individually with common areas designed to be shared among the roommates (giving yourself, the owner, more privacy).

These methods of house hacking work the best for very desirable and expensive areas. This is because these are the markets where people are happy to pay $500 – $1,000 for a room with shared common areas.

Let’s look at another Chicago-based example of what this can look like:

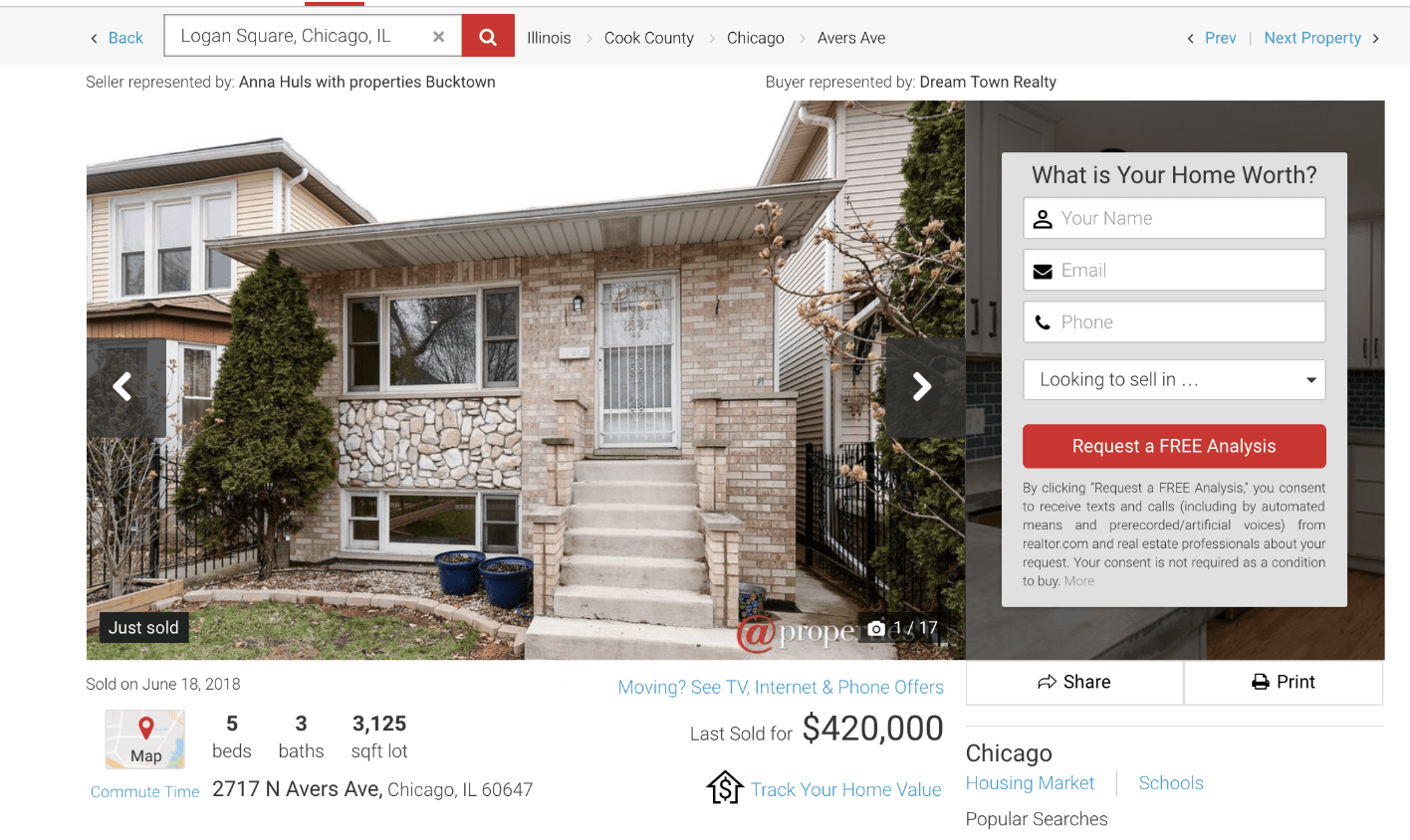

This property in Logan Square (an extremely hot neighboorhood in Chicago) recently sold for $420,000. It has five bedrooms.

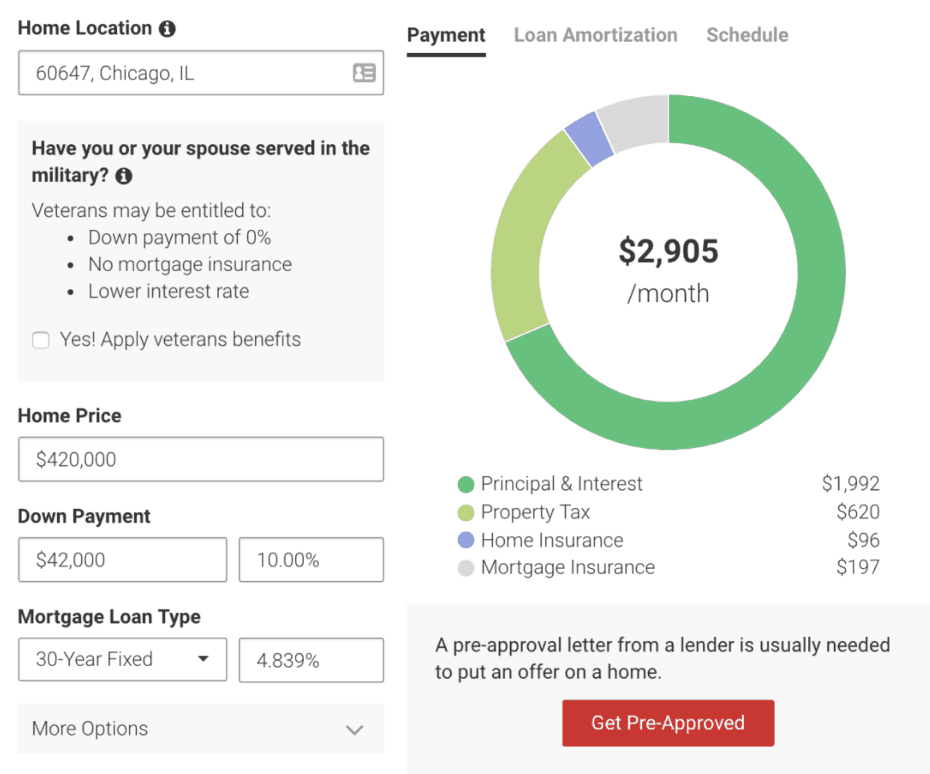

If we use the mortgage calculator again, we’re looking at $2,905 per month in housing costs:

(Note: Different loan programs, with different down payment amounts, may increase or decrease the monthly mortgage costs. Above, I’m using 10% down as a general ball-park for the sake of example).

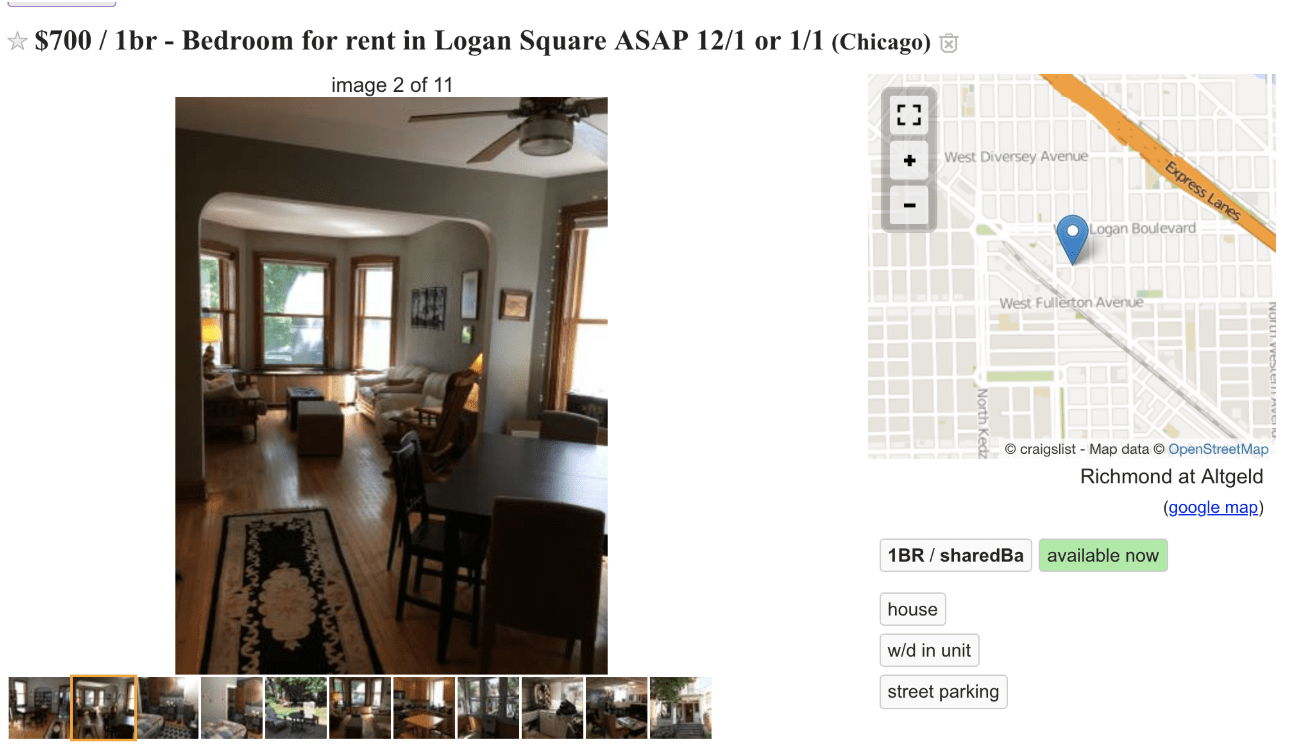

If we look at Craigslist to see what other people are renting their rooms out for in Logan Square, we get about $700 per room:

If we have four out of the five bedrooms rented (because, obviously, you need a bedroom for yourself) at $700 per room, that brings in $2,800 per month ($700 * 4 rooms = $2,800).

Again, our mortgage costs are $2,905, so that means we still have to come up with $105 per month to cover the rest of this monthly payment.

If all you had to pay was $105 per month in housing expenses and you got to live in the heart of a massively desirable city, would it be worth it?

I think so!

Now, don't forget: You're still on the hook for maintenance costs associated with the house, but this is the same risk you face with any kind of home ownership.

The upside when you house hack with roommates is that because you’re saving so much money per month on your mortgage, you can now easily save for these unexpected events.

Pros:

- You can typically live in one of the more desirable neighborhoods of the city.

- Since this property is a single family house, it may be easier to manage maintenance costs.

- You can live in more of a “community” environment, which creates fond memories and experiences (assuming your roommates aren't crazy).